제가 다닌 학교는 The University of Texas at Austin - MBA 이었습니다. 학교에 대한 소개는 링크를 통해서 확인해주세요.

YE SHALL KNOW THE TRUTH AND THE TRUTH SHALL MAKE YOU FREE

진리가 너희를 자유롭게 하리라 (John 8:32)

Lyrics

The Eyes of Texas are upon you,

All the livelong day.

The Eyes of Texas are upon you,

You cannot get away.

Do not think you can escape them

At night or early in the morn --

The Eyes of Texas are upon you

Til Gabriel blows his horn.

F2011 - Austin Intensive

F2011 - Statistics and Decision Analysis

Corse Information

This Course focuses on the application of data analytics, quantitative tools in business decisions. We will start with regression models and follow with concepts of conditional probability and decision analysis. Students will learn how to use regression to analyze a variety of complex real-world problems. Numerous empirical examples from finance, marketing, economics, politics, sports, etc are used to illustrate applications of the material covered. Emphasis will be placed on analysis of actual datasets. Topics covered include:

- Simple linear regression (단순회귀분석)

- Multiple regression (다중회귀분석)

- Prediction

- Residual diagnostics and time series forecasting

- Decision trees

- Monte Carlos simulation (몬테 카를로 모의)

F2011 - Managing People and Organizations

Course Objectives

To enhance understanding of employee behavior in organizations in order assist in your development as an effective organizational leader. Many business school courses teach you to manage information, money, and other material organizational resources. All of these skills will help you become a better manager, however; it is your "people skills' that will ultimately have the most impact on your ability to have sustainable success in the workplace. This course focuses on the patterns of interaction that occur among people and teams in organizations, and how those interactions impact the organizations. Theory informs Practics. This means that students learn best when they understand the underlying theoretical principles and then how those principles translate into specific behavioral practices, followed by actual implementation of those practices.

- Leading Change: Why Transformation Efforts Fail

- Change Through Persuasion

- Tipping Point Leadership

- Putting People First for Organizational Success

- Growing Talent as If your Business

- Depended on it

- Organizational Alignment

- Organizational Alignment: The 7-S Model

- Microsoft: Competing on Talent

- Hiring Without Firing

- What It Means to Work Here

- Getting New Hires Up to Speed Quickly

- Ritz-Carlton Hotel Co.

- Six Dangerous Myths About Pay

- On the Folly of Rewarding A Hoping for B

- Lincoln Electric Co.

- The Set-up-to-fail Syndrome

- Performance Management that Drives Results

- A New Game Plan for C Players

- Feedback That Works

- Rob Parson at Morgan Stanley (A)

- Harnessing the Science of Persuasion

- Exercising Influence

- Faire Process

- The Roller Coaster Ride

- A Note on Team Process

- Identity Issues in Teams

- Medisys Corp. The IntensCasre Product Development Team

- Introduction to Managerial Decision Making

- The Big Idea

- How to Make Values Count in Everyday Decisions

- The Fabric of Creativity

- The Failure-Tolerant Leader

- Managing a Global Team

- Greg James at Sun Microsystems

- Leadership That Gets Results

- Level 5 Leadership

- Managing Authentically

- Leadership in a (Permanent) Crisis

- Rebeca Halstead: Steadfast Leadership

- Fritidsresor Under Pressure (A)

- Lead for Loyalty

- The Art of Developing Leaders

- Leader Machines

- Are Leaders Portable?

- GE's Talent Machine: The Making of a CEO

- GE's Talent Machine: Immelt's Next Steps

- What is an Organization's Culture

- The People Who Make Organizations Go - or Stop

- The Office Chart That Really Counts

- How to Change a Culture

- Lessons from NUMMI

- Kimberly-Clark Andean Region: Creating a Winning Culture

- Cultural Intelligence

- Managing Multicultural Teams

- Trust Makes the Team Go Round

- Silva Napoli at Schindler India (A)

S2012 - Managerial Economics

Course Objectives

Economics is a misunderstood and recently, much-maligned field. These two factors are not unrelated, as those that disparage the work of economists often do so from a perspective indicating that they do not fully understand the message being delivered.

The course is divided into two discrete sections: Macroeconomics and Macroeconomics, the latter of which will also discuss issues in international economics. Macroeconomics is the study of consumer and firm behavior. This portion of the course is intended to provide the foundations of a framework that you can utilize to efficiently and competently make your own managerial decisions. Macroeconomics is the study of national economies. Broad economic forces can often influence an organization.

- The Apple iPhone

- Four Steps to Forecasting Total Market Demand

- Vital Truths About Managing Your Costs

- A New Product Introduction (A)

- Boeing and Airbus: Competitive Strategy in the Very-Large-Aircraft Market

- Judo in Action

- The Right Game: Use Game Theory to Shape Strategy

- Market Failures, Market Distortions, and Market Solutions

- Price Discrimination

- Past, Present, and Future

- China: Facing the 21 Century

- The I.S. Current Account Deficit

- Geithner and Bernanke Amid the Global Financial Crisis

- The Great Moderation

- Our Currency, Your Problem?

S2012 - Financial Accounting

Course Objectives

This course provides an introduction to the preparation, use, and interpretation of financial reports.

- Understand the concepts, principles, and methods used to prepare financial statements

- Link the effects of economic circumstances and management decisions to information reported in financial statements

- Apply knowledge of these areas when analyzing and interpreting financial statements

- Become aware of the limitations of financial statement information

- Financial Statements & Business Decisions

- Balance Sheet

- Income Statement

- Adjustments

- Communicating and Interpreting Acct Info

- Revenue & Receivables

- Cost of Goods and Sold and Inventory

- PPE; Natural Resources; Intangibles

- Liabilities [Financial Calulator]

- Bond

- Owner's equity

- Investments in Other Corporations

- Statement of Cash Flows

SU2012 - Marketing Management

Course Objectives

Marketing is the business function that addresses the design and implementation of strategies that create, build and sustain value for the firm's customers and captures a portion of that value for the firm. Successful design and implementation of marketing strategies involve the identification and measurement of customers' needs and wants, selection of appropriate customer segments for targeting the firm's marketing efforts, and the development and delivery of strategies that satisfy customers' needs and achieve the firm's performance objectives.

- Develop a structured and disciplined approach to the analysis of marketing problems

- Sharpen decision-making skills by making and defending marketing decisions in the context of realistic problem situations

- Appreciate how the elements of a successful marketing program fit together

Customer Behavior

- IKEA Invades America

- A Voyage from the Familiar

- Get Closer to Your Customers by Understanding How They Make Choices

Segmentation

- Mountain Man Brewing Company

- Market Customization: Market Segmentation, Targeting, and Positioning

Targeting and Positioning

- Reed Supermarkets: A New Wave of Competitors

- Brands and Branding

- Customer-Centered Brand Management

- Strategies to Fight: Low-Cost Rivals

- Customer Value Propositions in Business Markets

- Finding and Evaluating the Opportunity: Is It Real and Large Enough?

Customer Lifetime Value

- Retail Relay

- Customer Profitability, Darden Product

- The Right Customers: Acquisition, Retention, and Development

- Rethinking Marketing

Product Decisions

- Product Team Cialis Getting Ready to Market

- Are You Ignoring Trends that Could Shake Up Your Business?

- Is Justin Timberlake a Product of Cumulative Advantage?

Estimating Success for New Products

- Pillsbury Cookie Challenge

- Marketing Research: An Overview of Research Methods

- The Myth, the Math, the Sex

Managing Services

- Ocean Park: In the Face of Competition from Hong Kong Disneyland

- The Four Things a Service Business Must Get Right

- A Framework for Customer Relationship Management

- Zappos' CEO on Going to Extremes for Customers

Pricing Decisions

- Metabical: Pricing, Packaging, and Demand Forecasting for a New Weight-Loss

- Pricing and the Psychology of Consumption

- Pricing It Right: Strategies, Applications, and Pitfalls

- Who Benefits from Price Promotions?

- How to Stop Customers from Fixating on Price

Distribution Decisions

- Designs by Kate: The Power of Direct Sales

- Designing Channels of Distribution

- Trade Promotion: Essential to Selling Through Resellers

Promotion Decisions

- Charles Schwab & Co., Inc.: The "Talk to Chuck" Advertising campaign

- Integrated Marketing Communications

- Aflac's CEO Explains How He Fell for the Duck

SU2012 - Operations Management

Course Objectives

In this course, we present several analytical techniques - such as risk pooling, waiting line analysis, and network diagramming - which will aid you in managing processes in the real world.

Gained an improved understanding of

- how every organization uses processes to transform inputs into goods and services

- the importance of careful design, operation, and improvement of business processes

- the competitive potential of sound operations management

acquired the skills to

- analyze any manufacturing or service process to uncover improvement opportunities

- recommend process improvement along the dimensions of efficiency, quality, and speed

Operational Excellence

Understanding Processes

Inventory

Cost Structure

Understanding Projects

- Projects, Programme or Portfolio

- Critical Chain

Dealing With Uncertainty

Process Uncertainty

Inventory Uncertainty

- The Beer Game

Project Uncertainty

Quality Management

Supply Chain Management

F2012 - Austin Intensive 2

사진에서 저를 찾아보셔도 저는 없습니다. 저의 결혼식 참석으로 Intensive에는 불참하게 되었습니다. 다른 과목에서 뵙겠습니다.

F2012 - Financial Management

Course Objectives

- Introduce the concepts and theories of modern financial management

- Develop an appreciation for the usefulness of these theories for financial decision making

- Increase the student's financial decision-making skills

- Provide an overview of current financial management theories and practices

Readings

- A matter of life and debt

- Global business: in praise of the stateless multinational

- Information age: the 1% panic

- Loose Money and the roots of the crisis

- The $1.4 trillion question

- Money: the century's agony

Introduction and Overview

- Private Profit, Public Service

- State and Market

- Note on the Financial Perspective: What Should Entrepreneurs Know?

- Governing the Modern Corporation

- How to avoid getting lost in the numbers

- Small company Finance: What the Books Don't Say

- The Miracle of Trade

- The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else

Operating and Fianancial Leverage

Time, Value, Bond and Stock Valuation

- How Low Can They Go

- Yield to Maturity

- Introduction to Islamic Finance

Capital Budgeting

- Supplement on Capital Budgeting under Inflation

- Marketing Initiatives, Expected Cash Flows, and Shareholders' Wealth

- Corporate Strategy and the Capital budgeting Decision

- Shareholders' Wealth Maximizing Operating Decisions and Risk Management Practices in a Mixed Contracts Economy

- The Lexus and the Olive Tree

Risk and Expected Returns

- What Every CFO Should Know About Scientific Progress in Financial Economics: What Is Known and What REmains to be Resolved

- Risk as a History of Ideas

- ...About Higher Moments

- The New Financial Order: Risk in the 21st Century

Capital Structure

- Valuing Companies in Corporate Restructuring

- The Creation of First City Financial Corporation: A Clinical Study of the Bankruptcy Process

Cost of Capital and Valuation of the Levered Firm

- The Theory and Practice of Corporate Finance: Evidence from the Field

- A Note on Capital Cash Flow Valuation

- A Note on Valuing Equity Cash Flows

- A Note on Private Equity Securities

Financial distress and Capital Markets

- Raising Capital, Theory and Evidence

- Best Practices in Estimating the Cost of Capital

- The Other-World Philosophers

- Efficiency and Beyond

- Anomalies and Market Efficiency

- Inefficient Markets: An Introduction to Behavioral Finance 2000

- The Firm's Cost of Capital, Its Effective Marginal Tax Rate, and the Value of the Government's Tax Claim

Strategic Risk Managment

- A Note on Fair Value

- Investment Opportunities as Real Options: Getting Started on the Numbers

- A Note on Private Equity Securities

- Pennies from Hell

- Sulphur Dioxide Allowance: The Price of Pollution

- Real Options: State of the Practice

- The Impact of Risk Management

- Options way of thinking

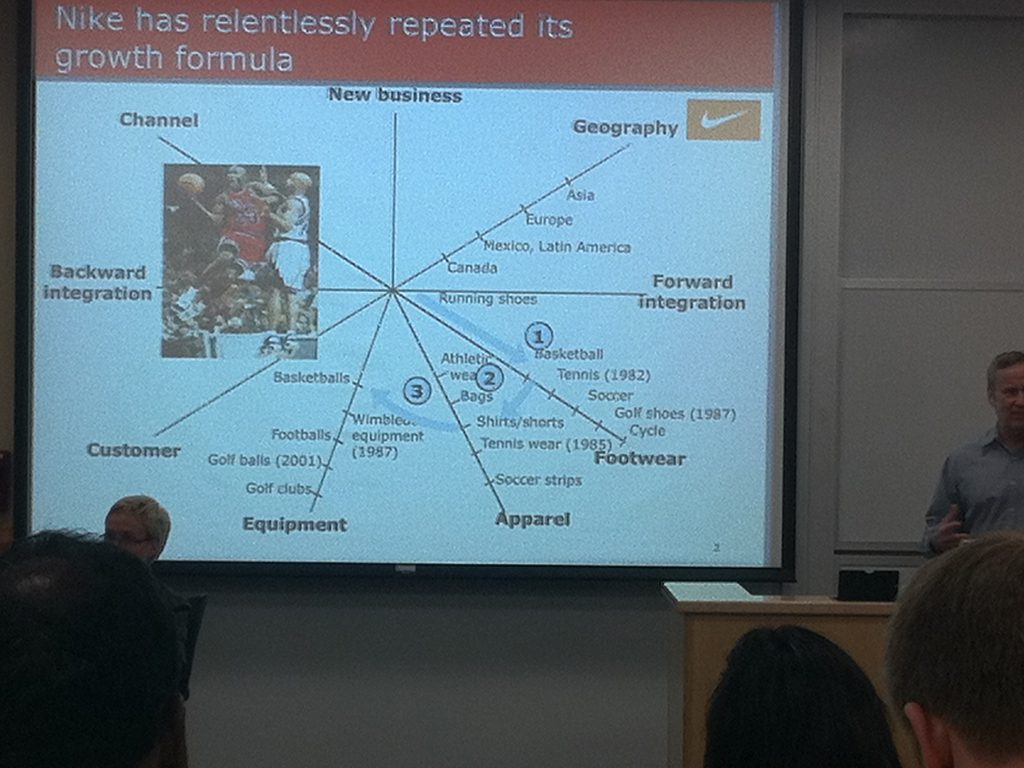

F2012 - Strategic Management

Corse Objectives

The traditional purpose of this course is to help you integrate your knowledge of the functional areas of business into a holistic view of the firm and thereby determine and execute proper business level and corporate strategies. The goal is to equip you with a working knowledge of the tools and concepts associated with the strategic management process thereby facilitating your contribution to current and future organizations. You will learn how to conduct various levels of strategic analysis studies depending upon the intended use and audience. You will have a framework that will assist you in both accepting and implementing the strategies we will cover.

- To understand and apply the basic tools and concepts of strategic planning as they apply to a business and its various stakeholders

- To learn how to identify the key issues and drivers that determines a company's focus and strategy, stressing the emergence of a global economy

- Integrate and reinforce previous coursework, combining emphasis on independent research and the framework of strategic management provided by the text.

- Develop a sensitivity and understanding of various "constituencies" of a company and how they influence and are affected by a company's strategy

- Strengthen and refine business writing and presentation skills by simulating a real-world business environment

- Exercise your ability to separate underlying business problems and issues from the symptoms

- Develop a logical framework to approach the question "what do you think about this company as a vendor, competitor, potential acquisition or partner".

- Develop an appreciation and general understanding of the realities of running a complex organization in a global environment

Making mergers and acquisitions work: Strategic and psychological preparation

Introduction

- Cameron Auto Parts

Stakeholder Role in Strategic Management

- Robin Hood

Analyzing the External Environment

- Movie Exhibition Industry

- Global Wine Wars

Assessing the Internal Environment

- WWE

Recognizing Intellectual Assets

- Ann Taylor

- Globalization of Cemex

- Jamba Juice

- Jollibee Foods

Corporate Level Strategies

- Paragon Tools

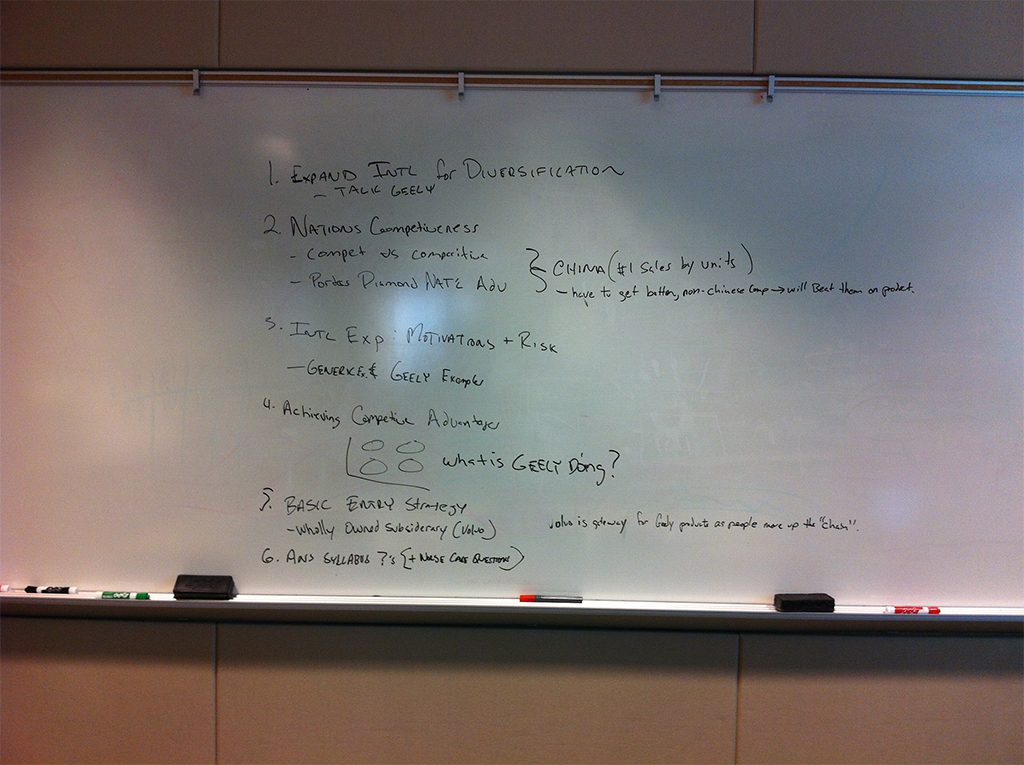

Global/International Strategies

- Geely Automotive

- Bombardier

Entrepreneurial Strategies

- Edward Marshall Boehm

Strategic Control and Corporate Governance

- Automation Consulting Services

- P&G in Japan

Strategic Leadership

- AIG

- Philips vs Matsushita

Managing Innovation and Fostering Corporate Entrepreneurship

- Genzyme

[ Strategy Tools ] ***

- SWOT

- Value Chain

- Porters Five Forces

- BCG Portfolio Matrix

- Core Competencies

- Goal Matrix

- Stakeholder Analysis

- RBV

- Restructuring

- Christensen Dilemma

- Financial Ratios

- Waterfall Charts

- Competitive Advantages

- General Electric Business Screen

- Environmental Scanning

- Product Life Cycle

- Global Competitive Diamond

- Globalization Drivers

- Contemporary Control Measures

S2013 - Directed Studies in Global Management

S2013 - Corporate Finance / Financial Markets

Course Overview

The objective of this course is to develop an understanding of the decisions financial manager face. In this course, we will approach problems from the perspective of the Chief Financial Officer. We will focus on decisions concerning raising money (equity, debt, convertible bonds, etc.) and spending money (project valuation). The first part of the course will deal with real investment decisions, while the second part will address decisions about how to finance those investments.

- Valuing REal Assets - Basic Concepts and Methods

- Relative Valuation Methods in Corporate Finance

- Capital Structure Policy

- Bankruptcy and Financial Distress Costs

- Information Conveyed by Financial Decisions

- M&A and the Market for Corporate Control; Case: Paramount 1993

SU2013 - Information Technology Management

Course Objectives

This course explores how innovative firms are effectively using digitally enabled strategies, operating models, and capabilities to win in hypercompetitive environments. The rapid and unflagging evolutions of digital technologies and global economic liberalization policies have fueled hyper-competition not just in high-tech industries but also in traditionally low-tech industries.

This course aims to equip students with a sound understanding of the fundamental shifts that drive big shifts in the economy and hyper-competition across a broad range of industries. The course examines how firms compete on information products and services that are subject to network externalities, switching costs, and lock-in. The course will also present emerging digital business models, digital governance structures, operating models, and principles of competing with digital business platforms. It will discuss how innovative firms are using business intelligence and data analytics capabilities to expand their capacity for sensemaking, learning, and improvising in complex, dynamically evolving competitive landscapes.

- What is Strategy?

- Corporate Strategy

- Competing on Resources

- The Five Forces: Competing for Profits -- Understanding Michael Porter's Best-Known Framework

- Understanding Michael Porter: The Essential Guide to competition and strategy

- How to discuss a case

- The Big Shirt: Measuring the Forces of Change

- Investing in the IT that makes a competitive difference

- Two's company, Three's a Crowd: Demystifying Complexity Science

- The Elusive Goal of Corporate Outperformance

- Robust adaptive strategies

- Simple Rules for a Complex World

- Three Rules for Making a Company Truly Great

- Danaher Corporation

- To execute your strategy, first, build your foundation

- Define your operating model

- Enterprise architecture a strategy: Creating a business foundation for execution

- USAA: Capturing Value from complexity

- Implement the operating model via enterprise architecture

- Navigate the stages of enterprise architecture maturity

- PepsiAmericas: Building an information savvy company

- Scalability: the paradox of human resources in e-commerce

- Inside P&G's digital revolution

- Building business agility at Southwest Airlines

- Post Merger Integration: Hard Data, Hard Truths

- Trinity Health: Exploiting a Digital Platform and a Unified Model to create Value in Merger, Acquisition, and Divestiture Transactions

- EMC Corporation: Managing IT M&A Integrations to Enable Profitable Growth by Acquisitions

- Big Data, Analytic and the Path from Insights to Value

- Before you make that big decision

- Trinity Health: Exploiting digitization, Unification, and Data Analytics to Tame Quality, Cost and Accessibility Problems of Healthcare

- Versioning: The Smart way to sell information

- The creative industries: The promise of digital technology

- Competing against free

- Symbian, Google & Apple in the Mobile Space (a)

- Platform-Mediated Networks: Definitions and Core concepts

- Apple Inc. in 2012

- Note on Multi-Sided Platforms: Economic Foundations and Strategy

- Do you really want to e an eBay?

- Microsoft's Search

- Strategy as a Wicked Problem

- Which strategy when?

- Zynga

SU2013 - Art and Science of Negotiation

Course Objectives

Negotiation is the art and science of securing an agreement between two or more interdependent parties. This course focuses on understanding the behavior of individuals, groups, and organizations in the context of competitive situations. The objectives of the course are to help students to develop negotiation skills experientially and to understand negotiation in useful analytical frameworks. Considerable emphasis is placed on realistic negotiation exercises and role-playing. the exercise serves as catalysts for the evaluation and discussion of different types of negotiation situations.

- Negotiation Genius

- Blue Buggy

- Energetics Meets Generex

- El-Tek

- Package Deal

- Oceania

- Federated Science Fund

- Cascade Manor

- Virtual Victorian

- Harborco

- Viking Investments

- Amanda

- Mexico Venture

- Bullard Houses

F2013 - Austin Intensive 3

F2013 - Advanced Marketing Management

Course Objectives

The primary objective of this course is to help you develop skills and gain experience in analyzing a business' situation and then formulate, implement, and monitor marketing strategy in a competitive environment. The course will focus specifically on issues such as the selecting segments in which to compete, developing meaningful points of differentiation and positioning statements, allocating resources, designing products, setting and managing prices, developing and managing distribution strategies, and developing and managing promotion strategies.

Framework and Opportunity Analysis

- Polyphonic

- Strategy

- Strategic Intent

STP and New Product Launch

- BioPure

- Clean Edge Razor

- Building a Business Model and Strategy: How They Work Together

Distribution Channels, Pricing, Customer Lifetime Value

- HEB Own Brands

- Virgin Mobile USA

- Atlantic Computer

- Developing New Products and Services: The Marketer's Role

Brands, Advertising, and Services

- Hilton Hotels

- Manchester Products

- Four Strategies for the Age of Smart Services

Intellectual Assets and Social Media

- Sephora

- IP Intermediaries

- Going to Market

New Platforms

- Amazon, Apple, Facebook, and Google

- Social Technographics Profile

Disruption, Innovation, Change

- Nintendo's Disruptive Strategy

- DuPont Kevlar

- Competitor Analysis: Understand Your Opponents

- Darwin and the Demon

Creating and Sustaining Value

- Kodak and the Digital Revolution

- Technical Note: Writing Great Marketing Plans

- Why Good Companies Go Bad

Evaluating Strategies

- Brannigan Foods

- Marketing Strategy: How It fits with Business Strategy

Marketing Plans

- Launching Krispy Natural

- Creating a Marketing Plan: An Overview

F2013 - Legal Environment of Business

- Legal Systems and International Issues

- Dispute Resolution

- U.S, Constitution

- Real Property

- Personal Property

- Intellectual Property

- Contracts

- Sales and Product Liability

- Torts

- Agency

- Business Entities

- Human Resources

- Bankruptcy

- Crimes

- Antitrust

S2014 - Managerial Accounting and FSA

Course Objectives

Managerial accounting focuses on how accounting and financial information is created and used inside an organization to assist an enterprise in implementing its business strategies to achieve its mission. Management accounting is a complement to financial statement analysis that tends to focus on annual reports, 10-K filings and similar other financial reports that are used primarily outside an enterprise by shareholders and the financial community when making decisions about investing in a company.

- Create internal financial information

- Use this information as a component of strategic decision-making

- Use this information to measure success or failure relative to a plan

Costs, Expenses, and Margin

- Caribbean Internet Cafe

Budgeting

- Paying People to Lie

- Who Needs Budgets?

- Hanson SKi

- Codman & Shurtleff

Cost Assignment and Costing Models

- Why Wine Costs What it Does

- Seligram ETO

Activity-Based Costing

- Assigning the Expenses of Capacity Resources

- Siemens EMW

Cost-Volume-Profit Analysis

- Bill French, Accountant

Decision Making: Relevant Costs and Benefits

- Baldwin Bicycle

Investment Centers and Transfer Pricing

- Compagnie du Froid

Standard Costing and Operational Performance Measures

- Citibank Performance Evaluation

Levers of Control

- Control in an Age of Empowerment

- The Cost Center that Paid Its Way

- automation consulting

S2014 - Business Ethics

- Introduction and Honesty

- Stakeholder Theory, Fairness, and Accounting

- Employment

- Marketing

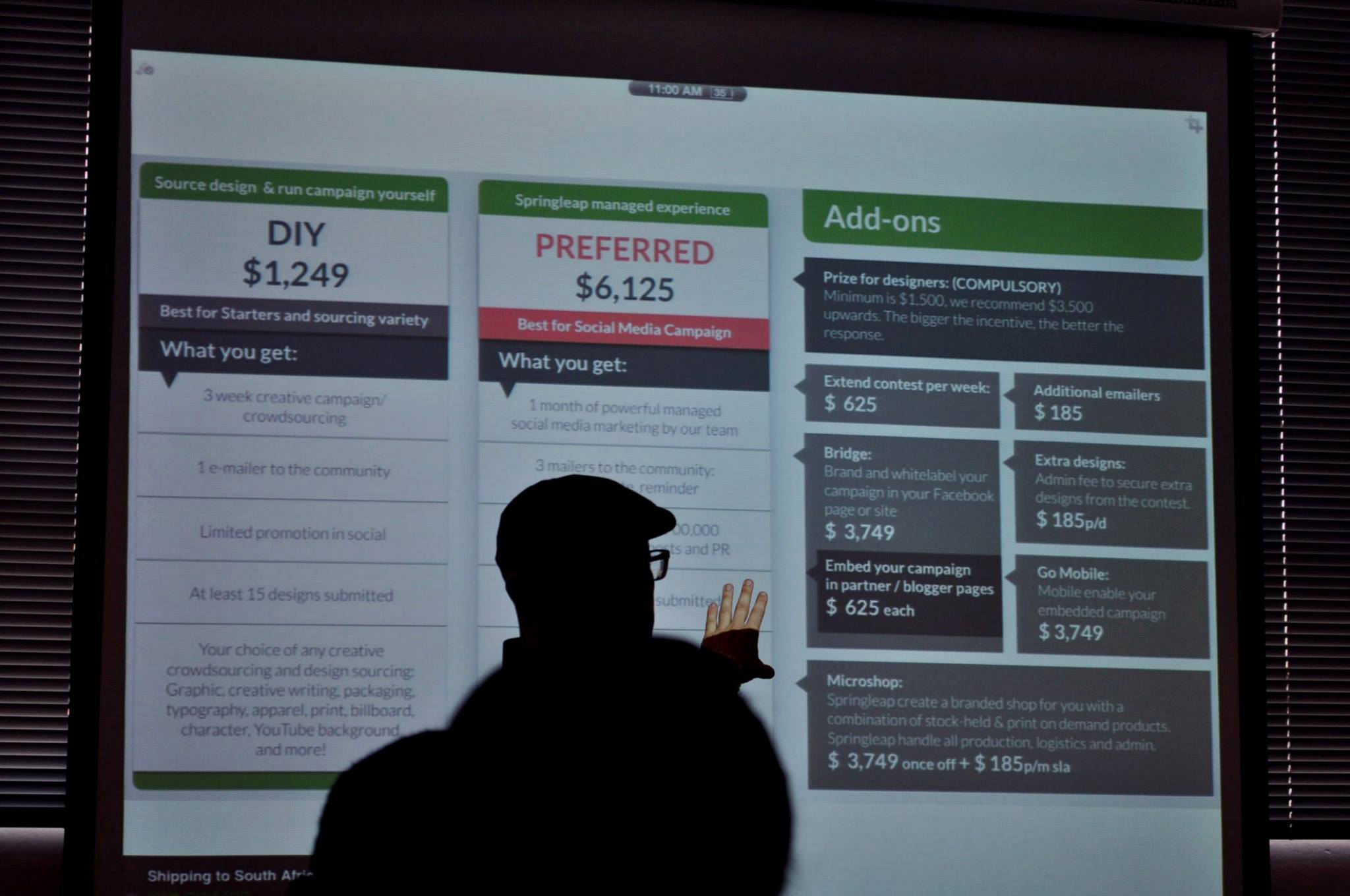

S2014 - Capstone Integrated

Course Objective

The academic goal is to develop the skills necessary for evaluating and creating a new venture, with the ability to communicate the endeavor effectively through written and verbal presentation. You will be able to evaluate business opportunities as an executive in an established company, and as an entrepreneur or investor within a start-up. The goal of this course is to integrate the learning from throughout the MBA program to develop a business plan. The business goal is to get you comfortable building and evaluating new product and business opportunities both as an entrepreneur starting a company and an operator within an established company. this course treats entrepreneurship as a form of strategy.

|

|

▼

|

|

|

▼

|

|

▼